Key Takeaways:

- Since 2020, Walmart’s ad platform has been growing to keep pace with Amazon

- Amazon retains superior visibility while Walmart poses advantages for more well-known brands

- CPC remains lower on Walmart even as its keyword targeting system lags behind

- Both ad platforms can be used effectively with a tailored marketing strategy

A Battle of Paid Advertising

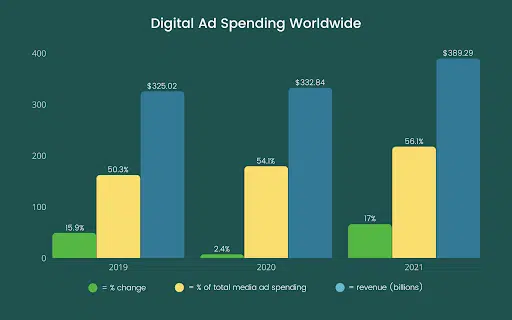

Walmart fortuitously launched its in-house advertising system in January 2020, mere months before the global pandemic would contribute to worldwide increases in digital ad revenue. Despite only 2.4% growth in the previous year, digital ad spending in 2021 is projected to be up 17%.

Walmart’s decision to expand the Walmart Media Group and nativize its ad campaigns through Polymorph Labs indicates a direct move against Amazon, the industry leader in eCommerce advertising. Brands deciding between these two platforms for their paid ads need an accurate breakdown of their strengths and weaknesses to bid strategically and budget efficiently.

Amazon Paid Advertising: What You Need to Know

Amazon Advertising Platform Overview

Some research projects that Amazon’s 2023 ad revenue will reach $40 billion. Their dominance in technology and their third-party marketplace has made them more successful as a digital advertiser than Walmart but also more competitive.

Strengths of Amazon Advertising

Improved product visibility – Amazon attracts more traffic than other eCommerce sites, which equates to more visibility for your products.

Brand engagement – Amazon’s product pages provide links to your store that customers can use to shop exclusively for your products.

More ads – Amazon offers more ad real estate than other sites. They offer more paid search and ad options on their pay-per-click system to attract customers at every stage of the buying cycle.

Weaknesses of Amazon Advertising

Small physical footprint – With few brick-and-mortar stores, Amazon has higher fulfillment costs and no in-store outreach.

Third-party competition – Amazon hosts third-party sellers but also sells its own products, creating potential competition between your brand and Amazon’s cheaper merchandise.

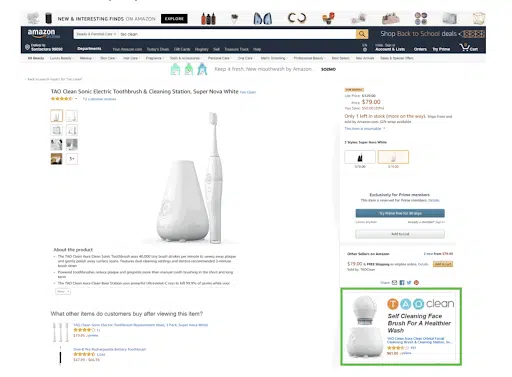

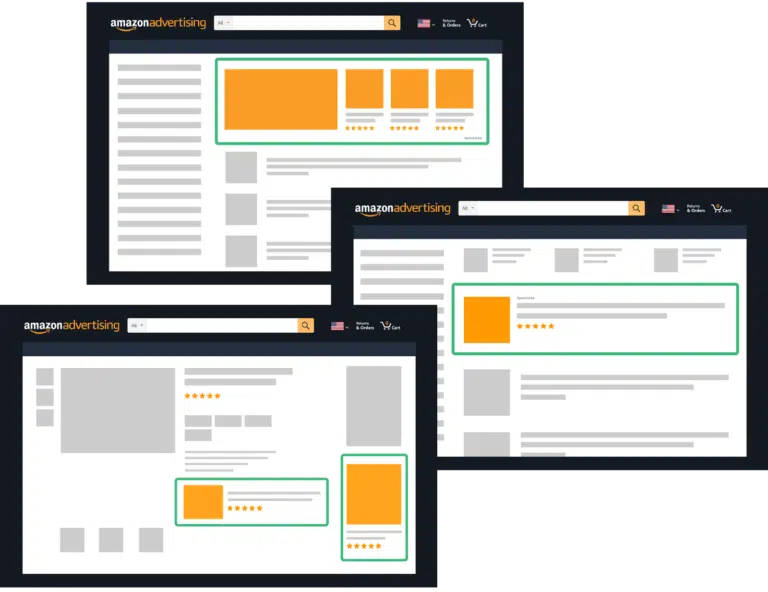

Ad Types on Amazon

The Amazon ad platform offers three types of ads. Knowing the difference is essential when preparing a marketing strategy for the platform.

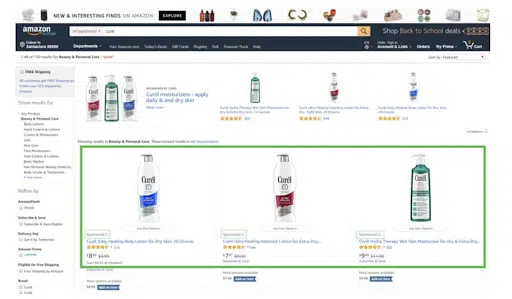

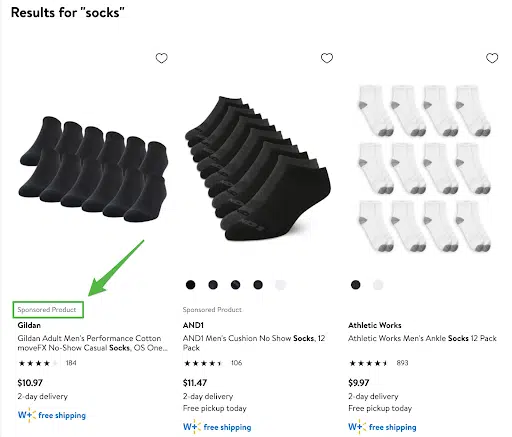

Sponsored Product Ads

Sponsored product ads appear at the top of results on search pages and your competition’s product pages. Amazon automatically targets the ad to advantageous keywords, making these ads easier for inexperienced advertisers to use effectively.

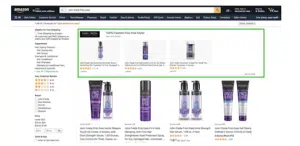

Sponsored Brand Ads

Sponsored brand ads allow companies to run banners for three or more products. They appear at the top of search results pages.

Sponsored Display Ads

Sponsored display ads can feature dozens of products, offering more opportunities for brand engagement. These ads appear advantageously below the “Add to Cart” button in the Amazon Buy Box.

Walmart Paid Advertising: What You Need to Know

Walmart Advertising Platform Overview

Walmart has devised a strategy to keep its eCommerce ambitions relevant in its paid advertising battle against Amazon: they use their stores as eCommerce warehouses. With 90% of Americans within 10 miles of Walmart stores, Walmart has been able to use its logistics network to slash fulfillment costs, which are the biggest operational cost of an eCommerce business.

Strengths of Walmart Advertising

Infrastructure – 85% of purchases still happen in brick-and-mortar stores and Walmart has over 11,400 of them.

Grocery pickup – Walmart stores offer grocery pickup the same day and free 2-day shipping on orders over $35 in food and household items. They have the support of other services like Instacart.

Delivery options –Walmart has several free delivery options that do not require a paid subscription, including free next-day shipping on qualifying orders and free 2-day shipping on orders worth more than $35.

Weaknesses of Walmart Advertising

Bidding expenses – Walmart’s first-price keyword auctions make it easy to overpay for search clicks.

Lack of product attribute targeting – When setting up a paid search ad, Walmart sellers can target keywords but not product attributes.

Low eCommerce experience – Not only does Walmart have less eCommerce experience, but they are also not as seller-friendly when it comes to pricing.

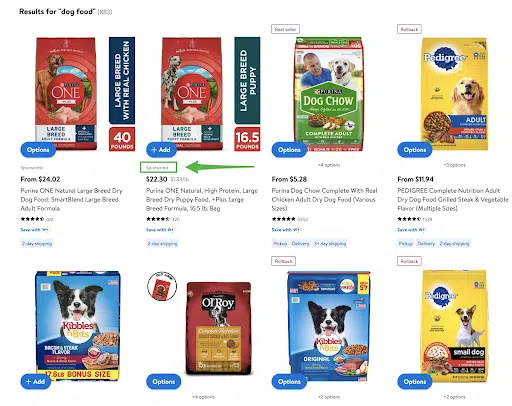

Walmart Sponsored Product Ads

Walmart allows sellers to set up automatic schedules for sponsored product ads on their site. The ads appear in several places, including the results page, in carousels around the site, and in banners that line the pages of related products. Sponsored products are chosen based on the brand’s performance in the Walmart Buy Box, where the cheapest prices generally win.

Amazon vs. Walmart: Key Differences

After reviewing the individual strengths and weaknesses of the two eCommerce giants, you may be wondering how they directly compare and which you should use. There is no single answer to which best matches your needs but understanding the key differences can help you decide.

An Overview of the Differences

Despite Amazon’s status as the world’s leading eCommerce business, Walmart has the infrastructure to store, pack, and deliver food, as well as other consumer goods. They have the support of digital shopping services like Instacart and the on-land infrastructure to cut fulfillment costs.

By contrast, Amazon has vast industry experience in eCommerce. They have remained successful by creating a consumer-focused marketplace. The consumer’s biggest pain points – selection, price, delivery, returns – are all handled as efficiently as possible.

As advertisers, these broad differences represent more specific factors that should be considered when weighing your options.

Lower CPC on Walmart

Both Walmart and Amazon use PPC or pay-per-click metrics for their paid ads. This means that a paid search does not cost the seller money until it generates clicks. Advertisers bid higher if they want to increase their brand’s presence in the market (known as “Share of Voice”) at the risk of increasing their cost-per-click for each of their paid ads (CPC).

On Walmart, CPC is an even playing field for all bidders. They use a first-price bidding system, which means that you pay the full amount of your winning bids. Sellers know what they will spend, which means that everyone bids more conservatively, reducing the CPC overall.

By contrast, Amazon uses a second-price system, which means that ads cost $0.01 more than the next highest bid. This ultimately raises the CPC on Amazon due to competitive bidding wars. Even though Amazon provides more visibility, your Advertising Cost of Sale on Amazon (ACoS) will likely still be higher.

More Visibility on Amazon

In 2021, Amazon attracts about five times as many visitors as Walmart. The difference may result in more bidding competition for sellers, but the increase in traffic inevitably increases your brand’s visibility on Amazon.

That visibility also extends to the site’s ad placements, which are more numerous on Amazon. Sponsored products appear both in search results and in banners at the top of the page, improving impressions on Amazon. As an eCommerce-only enterprise, its three ad types can be used to create more nuanced ad strategies, which raise your ad’s CTR or click-through rate simply by generating more visibility.

Walmart’s Keyword Targeting Limitations

Amazon allows sellers to use autotargeted keywords to strategize their ad spending, as well as target product categories for more bidding options. Walmart only offers keyword targeting. This changes how different kinds of sellers perform on each market.

Success on Amazon relies on maintaining a presence in an attributes-driven market where shoppers search for the kind of product they want. For instance, studies show that 78% of Amazon searches are unbranded.

By contrast, Walmart sellers rely more on maintaining brand exclusivity. This means that unknown brands may find it more difficult to win bids for popular keyword targets on Walmart.

Walmart’s Third-Party Advantages

Though Amazon supports third-party stores, they also sell their own products, which can lead to conflict. Amazon sometimes rebrands generic products and sells them in-house.

While Walmart also sells products, people more often shop on Walmart for name brands. Selling on Walmart can be advantageous for marketers who fear a losing battle bidding on Amazon’s more competitive product categories.

Amazon’s Limited Reporting Metrics

Amazon has never been known for complex seller analytics, particularly when it comes to consumer behavior. Walmart’s Sponsored Products already feature more comprehensive metrics that allow sellers to tune their paid ad strategies more accurately.

Strategic Takeaways for Success

There is no single winner between Amazon and Walmart when it comes to paid advertising. However, consider these strategies when making your choice:

- New advertisers with smaller budgets may find Walmart’s lower competition and lower CPC a better starting point. Since you must pay the full amount of your bid on Walmart, scale them to minimize risk to your ROAS. Amazon lets you bid high without remorse but remains more competitive as a result.

- Known brands may be able to make more headway on Walmart where customers shop for products they recognize, just as they do in the store.

- Choose ads based on your objectives. For instance, competitive brands bid for numerous less-expensive keywords to generate sales and place a few strategic bids on their most profitable targets.

- Since Amazon drives price erosion through competition, it requires a more active bidding presence. Walmart compares your prices to other stores and other sellers, favoring the cheapest possible options. Depending on your products, each offers different strategic drawbacks.

No matter which you choose, both platforms continue to grow and change. Amazon has the most to lose as Walmart makes headway in eCommerce with lower prices and better seller analytics, though Amazon still leads the market in both visibility and conversions.

Article by